Credit and duration risks are determinants of debt-investment

Credit rating is a score that evaluates the borrowers’ standing and repayment abilities

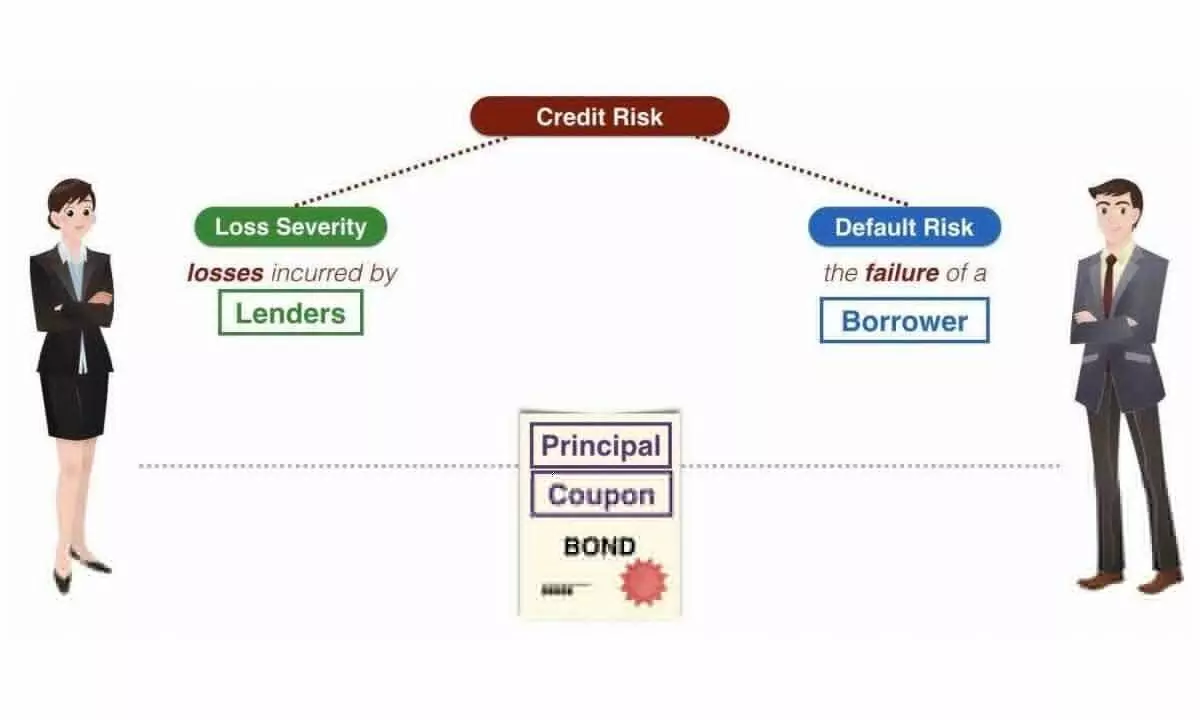

image for illustrative purpose

Duration risk is the risk that considers the probability of change in the interest rate favourably or unfavourably during the loan repayment cycle. The longer the duration, the more sensitive the bond's price is to changes in interest rates. This is because longer-duration bonds have more future cash flows, which are subject to greater uncertainty about future interest rates

Shivam: “Saakh -Aur- Avadhi Jokhim, Debt Nivesh Ke Do Nirdhaarak Hain.

Nivesh Karnaa Galat Nahi, Smajhanaa Jaroori Avashyak Hai.”

Translation: Credit risk and duration risks are real determinants of debt- investment

It’s not unwise to invest, though the pre-requisite is basic enlightenment.

Credit risk and duration risk are two kinds of risks that are often associated with a bond. Credit risk is the risk of defaulting on the repayment schedule whereby a borrower may not repay fully or partly the installment as per the terms and conditions agreed upon.

The borrower’s profile may play an important role in this context. Whether they have capacity or willingness to repay the loan or not has to be ascertained, first and foremost. Borrowers, who are considered higher credit risks, are generally charged higher interest rates.

However, this has a reverse effect too. If you charge higher interest rates from potential defaulters, then you are just making their work more difficult, and, as a consequence, the chances of default may increase.

Credit rating is a score which evaluates the quality of a borrower and judges them in in respect of their ability to repay the money on time. For retail borrowers it is called as CIBIL Score.

In respect of bonds, only if a company has a rating as BBB or more for a bond instrument will be considered as investment grade. Held-to-Maturity (HTM) securities are purchased to be owned until maturity. They are long term government dated securities or high credit rated corporate debt. They carry least risk to default.

From a bank’s perspective, credit risk may also include concentration risk, country risk, institutional risk, credit spread risk and downgrade risk.

Concentration risk means concentration of credit to specific types of borrowers; country risk refers to the disturbance in cash flow from international borrowers; institutional risk is about legal disturbances in the institution while credit spread risk means the change in the mix of private sector lending and government bonds.

Some of the ways to mitigate credit risks are proactive strategies, diversifying credit risk, investing in low-risk asset and maintaining sufficient credit risk capital and credit default swaps.

In proactive strategies, creditworthiness of potential borrowers is gauged on five ‘C’ parameters- character, capacity, capital, collateral, and conditions.

Credit Default Swaps (CDS) are about borrowing insurance for default scenario. Duration risk is the risk that considers the probability of change in the interest rate favourably or unfavourably during the loan repayment cycle. The longer the duration, the more sensitive the bond's price is to changes in interest rates.

This is because longer-duration bonds have more future cash flows, which are subject to greater uncertainty about future interest rates. Generally, the higher a bond's duration, the more its value will fall as interest rates rise, because when rates go up, bond values fall and vice versa. There can be one or several causes of duration risk like interest rate volatility, macroeconomic factors, and company-specific factors.

Exchanging fixed interest rates loans with varying interest rate ones can be one of the ways of mitigating this risk. The other way can be to buy options on interest rate. Setting up a duration guideline for one’s portfolio and making the portfolio more diversified can also be adopted to limit the duration risk.

Thus, we find that the credit and duration risks boil down to be the important determinants of a particular debt instrument for investment as aptly elucidated in the discussed couplet.

(The writer is senior vice-president, SBI Funds Management Ltd; (Translation and Synopsis by Hemant Kumar Das, MBA (Fin.) Option Trader & Independent Financial Advisor)